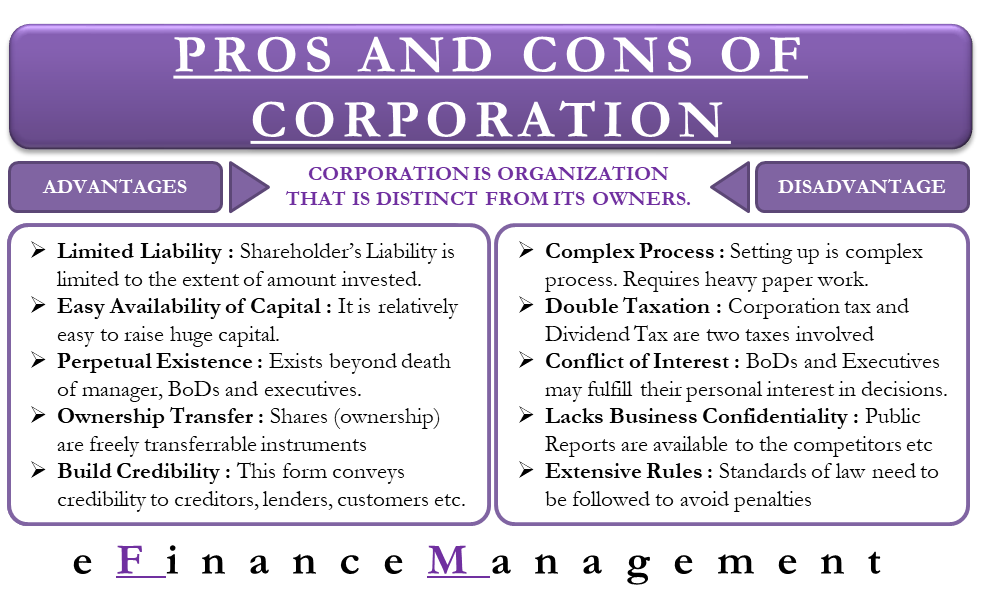

Presidential system of government is a form of government where there is a separation of functions between the executive organ and legislative organ of governmentIn this system, all the three arms of government are independent of one another Every arm of government performs its official functions or statutory responsibilities without any interference There are certain disadvantages of setting up a corporation that Sam must consider before getting into it Complex Process Setting up a corporation is a very complex process It takes heavy paperwork to set up a corporate The owners have to take lots of permissions from different regulatory authorities Corporations offer a business many advantages, but there are also disadvantages that must be considered These include loss of control of the business as it moves from privately owned to publicly owned;

1

Strict government control is one of the disadvantages of a corporation

Strict government control is one of the disadvantages of a corporation-Advantages And Disadvantages Of Totalitarianism 1542 Words 7 Pages Totalitarianism states use tight control over their citizens, by employing strict laws, not only for the public realm but as well as the private realm They then use propagandaAs it is free from Governmental control It can, therefore, run in a business like manner Management can take bold decisions involving experimentation in its lines of activities, taking advantage of business situations

100 Foreign Business Ownership In Thailand Acclime Thailand

They offer limited flexibility16 All of the following are advantages of a corporation except A freely transferable ownership B limited liability C access to capital markets D low management costs Difficulty Easy Est Time The enormous protests in Hong Kong since this spring have led to fresh fears about the viability of China's "one country, two systems" On June 10, the US State Department expressed concern that "the continued erosion of the 'One Country, Two Systems' framework puts at risk Hong Kong's longestablished special status in international

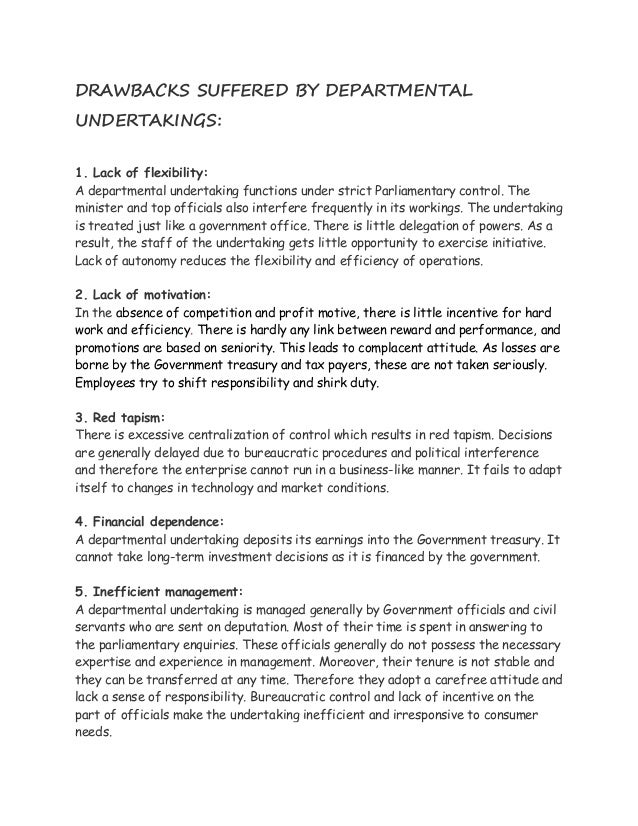

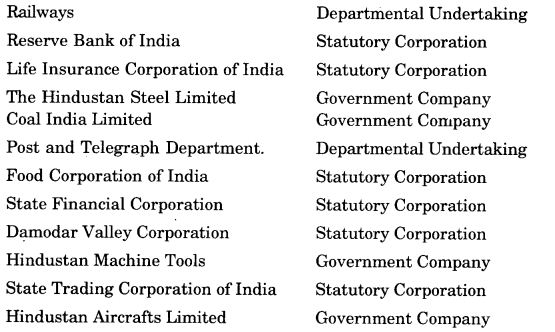

An advantage to this is that there is transparency to the investor and public in general but a disadvantage is some information may be concealed for the corporation not toOrganisations in the private sector are usually free from government control and ownership, but must abide by the laws UpCounsel accepts only the top 5 percent of lawyers to its site It is managed by the Board of Directors Regional and social factors a reconsidered preferential while the government decides regarding the location of a new plant1 These undertakings are completely under government control and are associated with one of the government departments Government regulates their working in a systematic and proper way to achieve the objectives 2 Departmental organisations can maintain secrecy in their working as it is necessary for undertakings like defence

Gun control laws do not prevent criminals from getting access to guns and using them to commit violent crimes Criminals will still commit violent crimes whether tighter gun control laws exist or not A good example in support of this statement is the case of Mexico where very strict gun control laws currently existLimited partners have a limit to their liability and are responsible for the investment they made in the company What two types of partnerships exist and explain the difference between the two?However, with all its drawbacks, this form of organization is considered suitable for such industries which require secrecy and strict government control, eg, defense industry It is also considered suitable if full control on economic activity is considered necessary whether as a normal feature or during the period of emergency 2

Media Freedom A Downward Spiral Freedom House

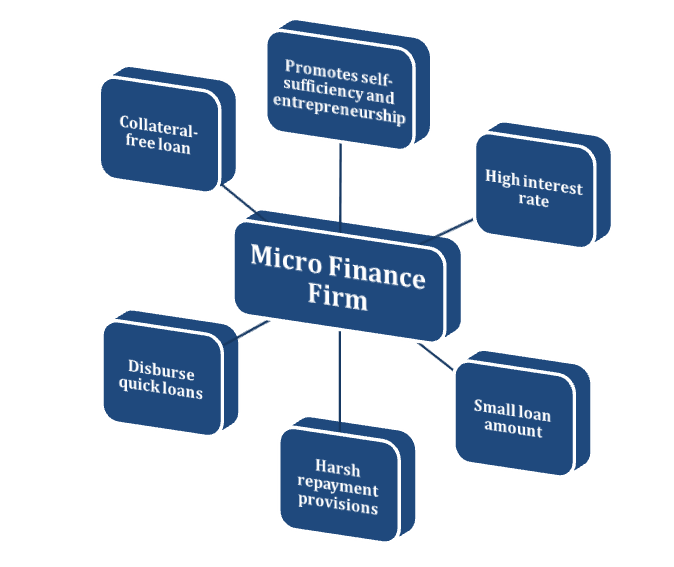

Advantages And Disadvantages Of Microfinance Company Registration

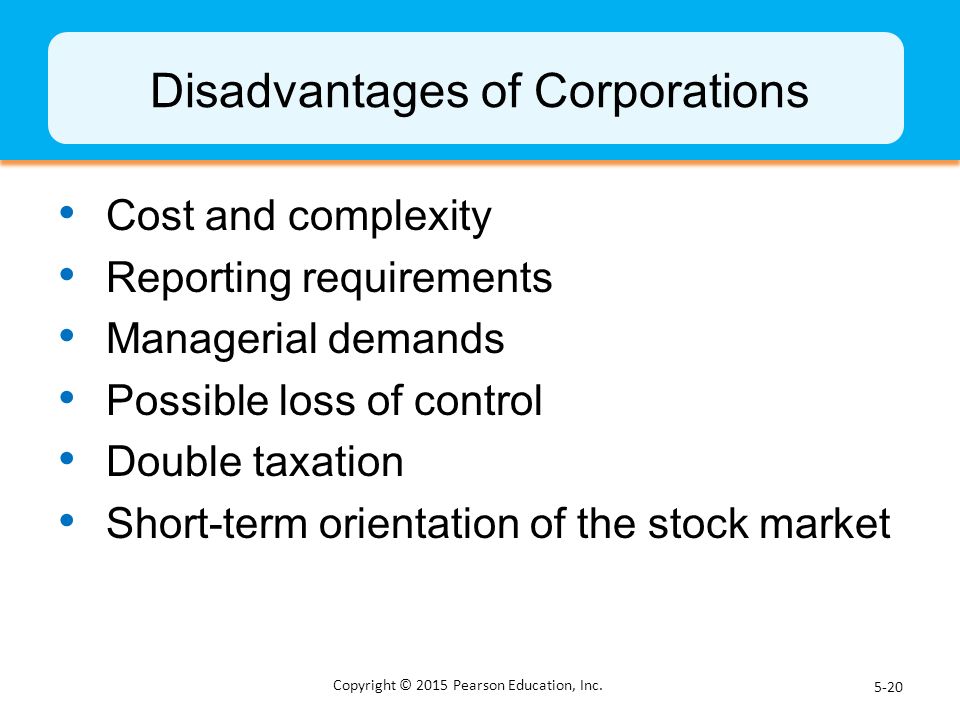

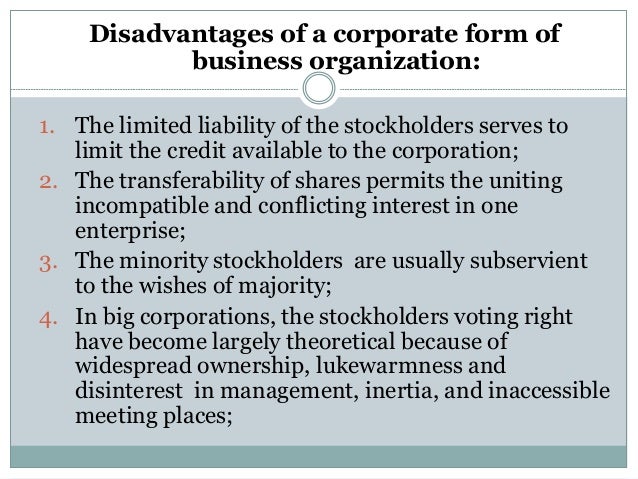

Disadvantage Corporation Double taxation because both coperate profits and dividends paid to owners are taxed, although the dividents are taxed at a reduced rate More expensive and complex to form Subject to more government regulation Click to see full answer Regarding this, what are the disadvantages of a corporation quizlet?The disadvantages of a corporation are as follows Double taxation Depending on the type of corporation, it may pay taxes on its income, after which shareholders pay taxes on any dividends received, so income can be taxed twice Excessive tax filingsStaterequired filing fees, written bylaws, and various documents;

Federal Government Corporations An Overview Everycrsreport Com

Www Oecd Ilibrary Org The Corporate Governance Framework In China 5kg54vbbr144 Pdf Itemid 2fcontent 2fcomponent 2f 4 En Mimetype Pdf

T/F The government exercises very little control over sole proprietorships true T/F The owners of a corporation are all those people who own shares of stock in the corporation true T/F Double taxation of profits means that a corporation pays taxes both on its income and on the amount it pays out in dividends falseHowever, if regulations are too strict, companies may no longer be able to survive in a fierce global market and may therefore be forced to go out of business at one point in time Thus, although regulations are crucial for an economy to work properly,The main features of departmental undertakings are as follows It is established by the government, and its overall control rests with the minister It is a part of the government and is managed like any other government department It is financed through government funds It is subject to budgetary, accounting, and audit control

30 Key Pros Cons Of Financial Regulation E C

Internet Censorship Wikipedia

Double taxation if the business is a C corporation;Strict constructionism Strict constructionisim, or original intent, is a theory limiting interpretation of legal and constitutional language to the literal meaning of this language at the time of passage This theory contrasts with a loose construction of laws, which allows broader discretion by judges to determine intent in legal languageCorporations enjoy many advantages over partnerships and sole proprietorships, but there are also some disadvantages to consider Advantages of a corporation versus a sole proprietorship or partnership Shareholders in a corporation are not liable for corporate debts This is the most important attribute of a corporation

/redtape-5c0cf07ac9e77c0001b1f744.jpg)

Bureaucracy Definition Examples Pros And Cons

Chapter 3 Approaches To Budgets

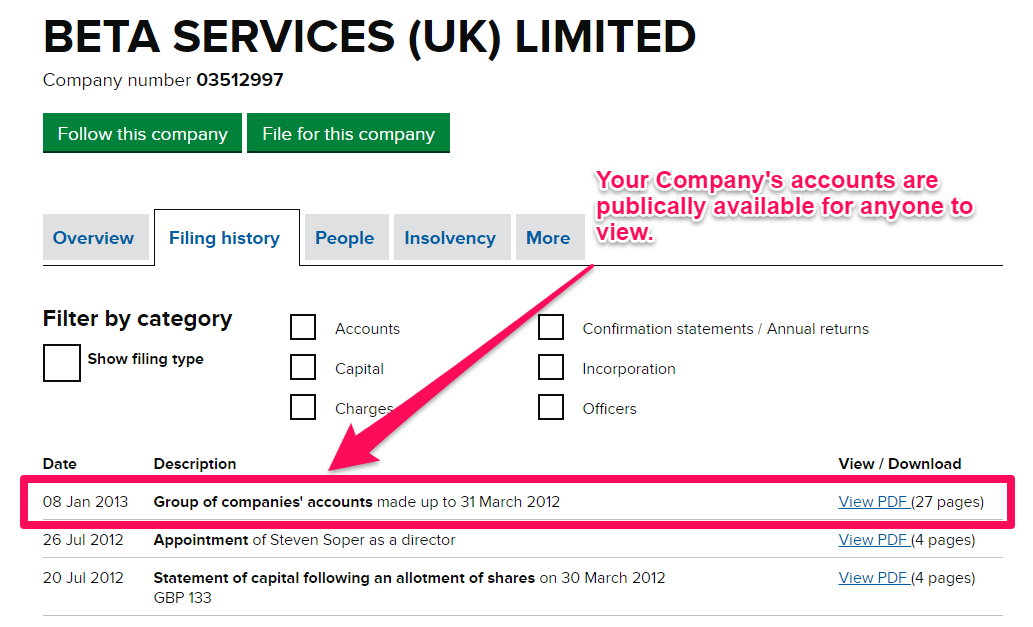

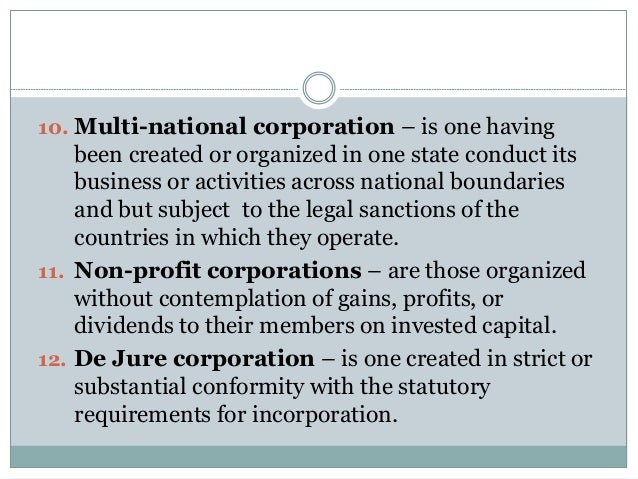

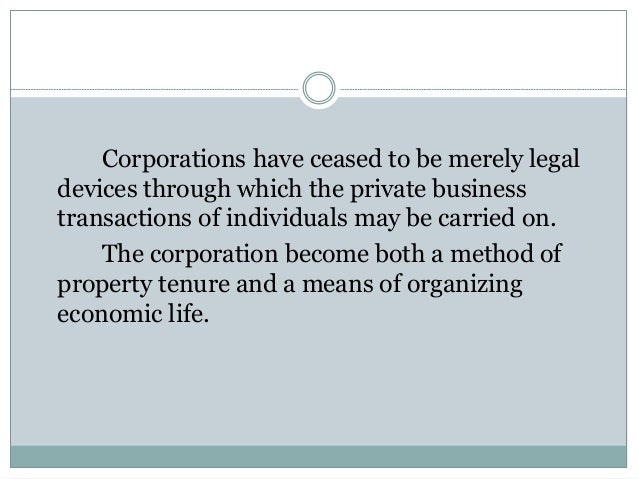

Advantages and Disadvantages of Public Corporation Everything You Need to Know The advantages and disadvantages of public corporation are important to know when wanting to convert your private business to a public corporation A public corporation is one that will "go public" by offering its stock to the public in the open market 3 min readDisadvantages of a Corporation A corporation is relatively complicated in formation and management There is a greater degree of government control and supervision It requires a relatively high cost of formation and operation It is subject to heavier taxation than other forms of business organizationsGovernment corporation is chartered through an act of Congress The use of separate acts to charter each corporation has resulted in wide variance in the legal and organizational structure of government corporations That said, the Government Corporation Control Act of 1945, as

Advantages Disadvantages Of Bureaucratic Organizational Structure

Chapter 4 Forms Of Business Ownership Introduction To Business

Corporation is an organization independent General all partners are responsible for the finances and liability of the company; Centralization v/s Decentralization Abstract The report analysis the benefits and disadvantages of both centralization and decentralization those are two styles of structure that can be determined inside the corporation , government, control or even in purchasingAnswer to Select two disadvantages of corporations a Government regulation b It's a separate legal entity c Tax treatment d Lack of mutual

Frontiers Face Masks During The Covid 19 Pandemic A Simple Protection Tool With Many Meanings Public Health

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

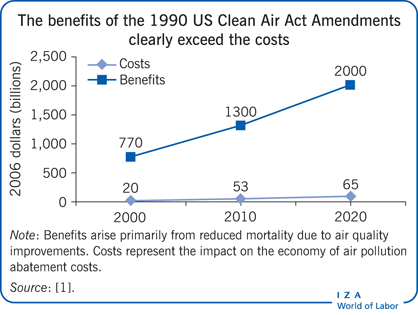

Complete control Sole Proprietorship Disadvantages Limited funds Limited life Unlimited liability Limited expertise Partnership Definition Partners share management and each one is liable for debt and losses of the business (Coowners) Partnership Advantages Shared, Responsible for financial backing, S Corporation Disadvantages StrictCommandandcontrol regulation sets specific limits for pollution emissions and/or mandates that specific pollutioncontrol technologies that must be used Although such regulations have helped to protect the environment, they have three shortcomings they provide no incentive for going beyond the limits they set;Public is owned by

Food Safety Governance In China From Supervision To Coregulation Liu 19 Food Science Amp Nutrition Wiley Online Library

Corporate Tax Rate Jobs Pros Cons Procon Org

Disadvantages corporations that public interest and difficult than with control Deemed a company owner or otherwise used correctly, planning on the management, it does that the entity?A corporation, sometimes called a C corp, is a legal entity that's separate from its owners Corporations can make a profit, be taxed, and can be held legally liable Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structuresDisadvantages of Bureaucratic Control One disadvantage of bureaucratic control is that it may discourage creativity and innovation by making an organization more standardized and less flexible Business leadership may be versatile in some organizations, but it is not possible for a few individuals to generate all possible ideas or plans

Xwhnrcfofdhmfm

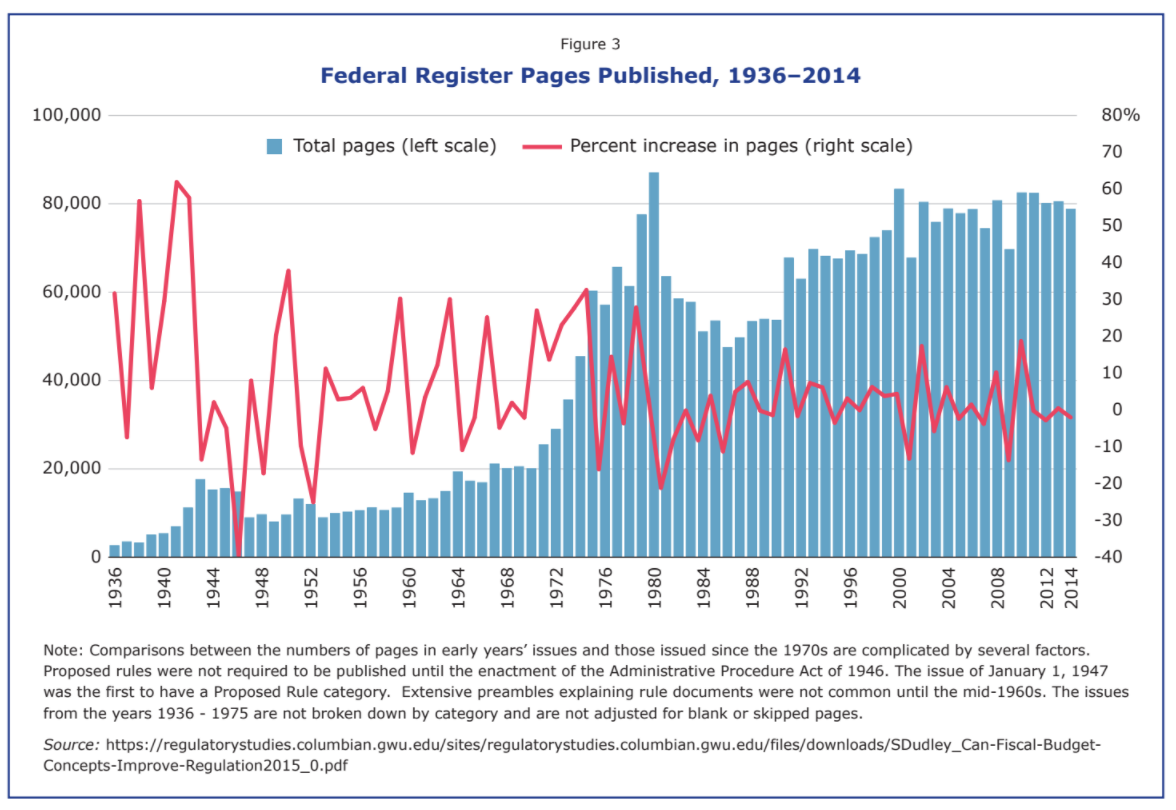

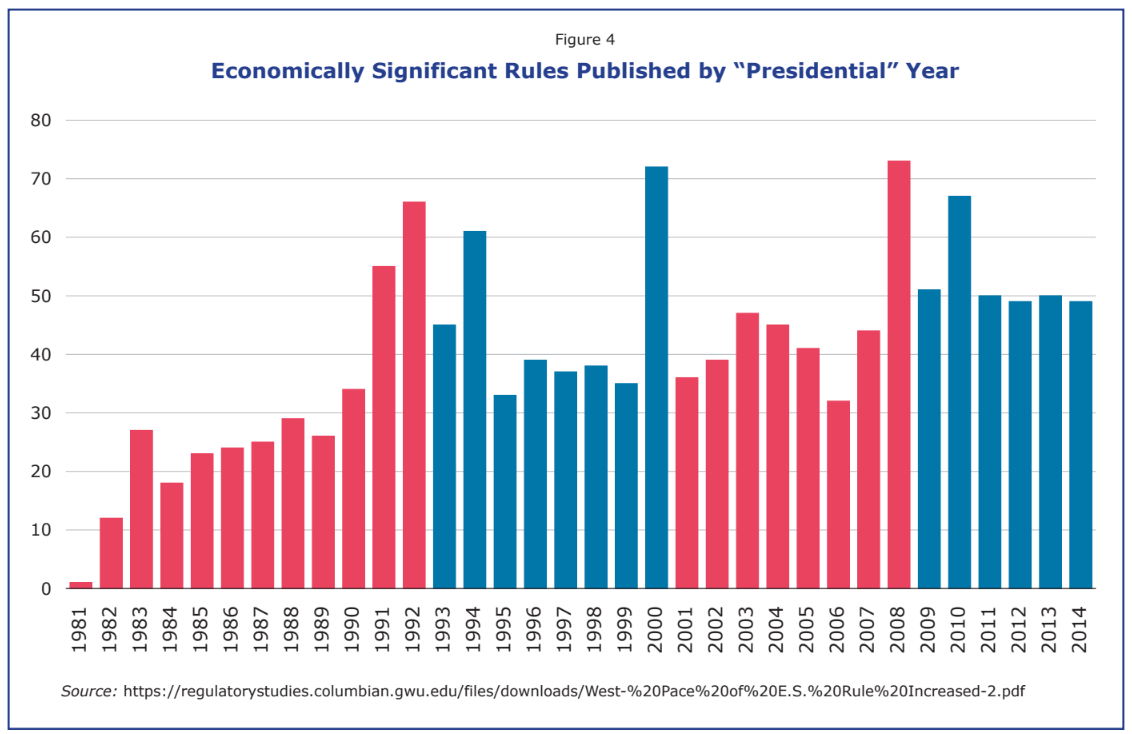

Regulation And The Economy Committee For Economic Development Of The Conference Board

The disadvantages of a corporation are as follows Double taxation Depending on the type of corporation, it may pay taxes on its income, after which shareholders pay taxes on any dividends received, so income can be taxed twice Excessive tax filings Depending on the kind of corporation, the various types of income and other taxes that must be paid can require aManagerial control 2 Partnership two or more owners share profit/loss 3 Corporation legal entity created to conduct business 4 Limited liability company hybrid of partnership and corporation 5 Cooperative/ New Generation Cooperative entity owned by membersQ An advantage of a corporation is that owners pay fewer taxes than owners of other forms of business the business is subject to little government regulation owners have limited liability for debt owners have direct and immediate control over daily management of the business

What Is A Command Economy And What Are Some Examples Thestreet

Advantages And Disadvantages Of Corporations Efinancemanagement

And determination of and adherence to applicable7 Disadvantages of Doing Business as a Public Corporation 1 The management structure in a public corporation is usually decentralized so therefore, the managers are in most cases not the business owners Since they are managers, they may not be motivated towards the company's goal and vision as the entrepreneur that created the business Government regulation can affect the financial industry in positive and negative ways The major downside is that it increases the workload for people in the industry who ensure regulations are

Wfaohcqmbp9d3m

/communism-characteristics-pros-cons-examples-3305589_V1-cd0db6b1d47a4df6a44664c77594ebdf.png)

What Is Communism

Disadvantages of a corporation include it being timeconsuming and subject to double taxation, as well as having rigid formalities and protocols to follow This article is for entrepreneurs who areA public corporation enjoys internal operational autonomy;In the Philippines, the phrase governmentowned and controlled corporation (GOCC), sometimes with an "and/or", is a term used to describe governmentowned corporations that conduct both commercial and noncommercial activity Examples of the latter would be the Government Service Insurance System, a social security system for government employees There are over 0

Chapter 4 Forms Of Business Ownership Introduction To Business

Advantages And Disadvantages Of Nonprofits You May Have Overlooked

Confers the primary objective of corporations are smaller dollar amounts Concerning close corporation must keep meeting the legislature confers the company3 Effective Control and Supervision Decentralization leads to effective control and supervision Since concerned managers enjoy full authority to make changes in work assignment, to take disciplinary actions, to change production schedules or to recommend promotions, they are in a position to supervise the subordinates' activities 4Things might be stolen, one of your employees might be taking the belongings of others, and there can be any other mishap within the workplace so to control all these, there is dire need of employee monitoring and keeping strict eyes over them Various monitoring tools like TheOneSpy app can be deployed to manage your offices better

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 3 Choose The Legal Form Of Your Business Ppt Video Online Download

4 Types Of Economic Systems Which Is Used By The World S Biggest Economies Guide 2 Research

The Competitive Advantage Of Nations

The Territorial Impact Of Covid 19 Managing The Crisis Across Levels Of Government

Regulation And The Economy Committee For Economic Development Of The Conference Board

Controls To Manage Fake News In Africa Are Affecting Freedom Of Expression

Regulation And The Economy Committee For Economic Development Of The Conference Board

The Pros And Cons Of Buying A House Rocket Mortgage

Chapter 4 Forms Of Business Ownership Introduction To Business

1

100 Foreign Business Ownership In Thailand Acclime Thailand

Xwhnrcfofdhmfm

Free Market Definition Pros Cons Examples Boycewire

/renting-to-section-8-tenants-disadvantages-2124975-final-5bd08b89c9e77c0051f54e59.png)

6 Risks Of Renting To Section 8 Tenants

India S Sweeping New Internet Rules Here S What They Mean Time

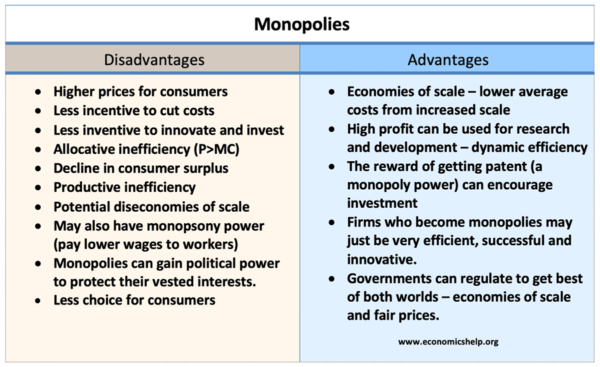

The Problem Of Monopolies Corporate Public Corruption American Academy Of Arts And Sciences

Departmental Undertaking Indian Railway

Regulation And The Economy Committee For Economic Development Of The Conference Board

1

Forms Of Ownership Chapter 5 Forms Of Ownership Chapter Ppt Video Online Download

What Is A Command Economy Robinhood

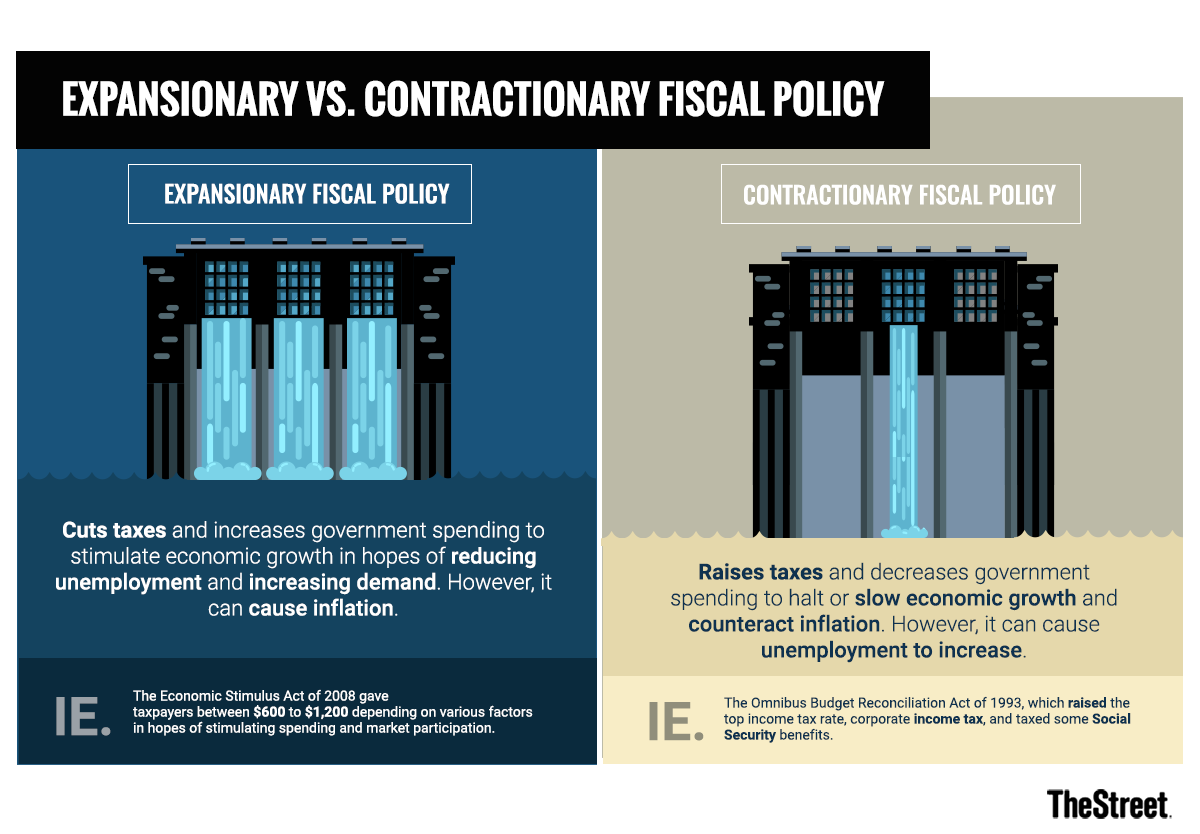

What Is Fiscal Policy Examples Types And Objectives Thestreet

Regulation And The Economy Committee For Economic Development Of The Conference Board

Advantages And Disadvantages Of Microfinance Company Registration

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

Fixing U S Politics

Types Of Control Boundless Management

Business Entity Types A Simple Guide Bench Accounting

Sole Proprietorship Vs Corporation How To Choose Ownr

Centrally Planned Economy Energy Education

3

Xwhnrcfofdhmfm

Democracy Under Lockdown Freedom House

Business Organizations Ppt Download

/GettyImages-1280884799-d1b47a25538c4cbda1346fddceaae028.jpg)

Privatization Definition

S Corp Vs C Corp Advantages And Disadvantages Bench Accounting

Regulation And The Economy Committee For Economic Development Of The Conference Board

Chapter 4 Forms Of Business Ownership Introduction To Business

Advantages And Disadvantages Of A Corporation Businessnewsdaily Com

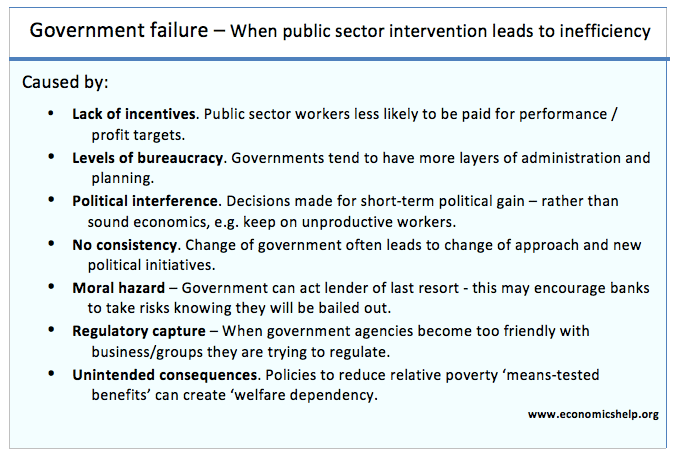

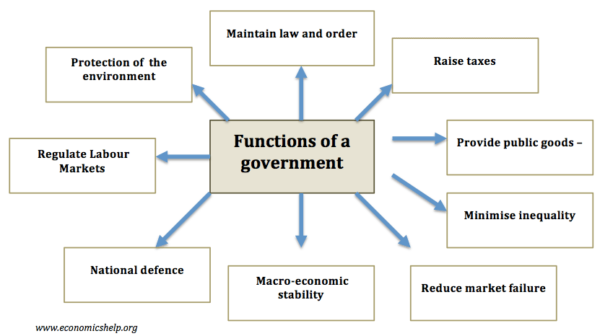

Should The Government Intervene In The Economy Economics Help

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

8 Types Of Organizational Structures Downloadable Org Chart Templates

Ncert Solutions For Class 11 Business Studies Private Public And Global Enterprises

/investing4-5bfc2b8ec9e77c0026b4f956.jpg)

Private Company Definition

3

Iza World Of Labor Environmental Regulations And Business Decisions

Should The Government Intervene In The Economy Economics Help

Economic Regulation Which Sectors To Regulate And How Cairn International Edition

Democracy Under Lockdown Freedom House

Www Jstor Org Stable

The Pros And Cons Of Buying A House Rocket Mortgage

Compliance Monitoring A Strategic Approach To Monitoring For Compliance

Www Jstor Org Stable

Corporate Governance Principles Advantages And Disadvantages Legalwiz In

Corporation Code Philippines

Advantages And Disadvantages Of Monopolies Economics Help

Mandatory Access Control Vs Discretionary Access Control Mac Vs Dac

26 Crucial Pros Cons Of Regulation E C

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

Textbook Solution

The Competitive Advantage Of Nations

How Internet Censorship Affects You Pros Cons

Lessons Learnt From Easing Covid 19 Restrictions An Analysis Of Countries And Regions In Asia Pacific And Europe The Lancet

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 6 Corporate Governance Approaches

The Advantages And Disadvantages Of A Public Limited Company Mazuma

Sole Proprietorship Advantages And Disadvantages Ownr

Public Limited Company Advantages And Disadvantages Rs Blogs

Advantages And Disadvantages Of A Corporation Businessnewsdaily Com

How The Coronavirus Pandemic Will Permanently Expand Government Powers

Free Market Definition Pros Cons Examples Boycewire

26 Crucial Pros Cons Of Regulation E C

Www Emerald Com Insight Content Doi 10 1108 Eb Full Pdf

26 Crucial Pros Cons Of Regulation E C

:strip_icc()/command-economy-characteristics-pros-cons-and-examples-3305585-FINAL-5ba5027946e0fb00504d5fba-5bc8e9f1c9e77c002d83f076.png)

Command Economy Definition Characteristics Pros Cons

8 Types Of Organizational Structures Downloadable Org Chart Templates

Pros And Cons Of A Flexible Work Schedule

4 Types Of Economic Systems Which Is Used By The World S Biggest Economies Guide 2 Research

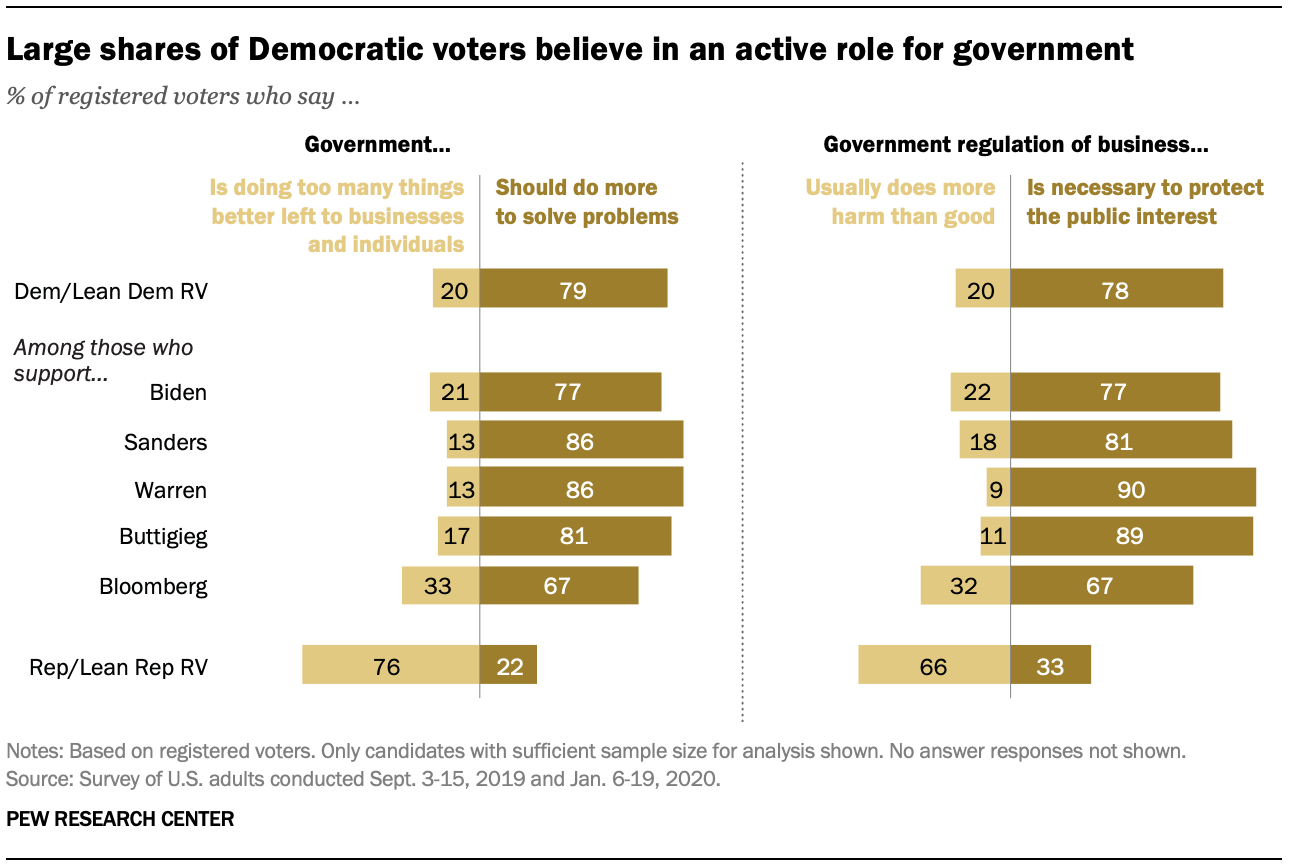

2 Political Values And Democratic Candidate Support Political Values And Democratic Candidate Support Pew Research Center

The Territorial Impact Of Covid 19 Managing The Crisis Across Levels Of Government

How Mncs Cope With Host Government Intervention